**Unlocking Financial Freedom: The SharkShop Method for Raising Your Credit Score**Are you tired of seeing your dreams slip away because of a less-than-stellar credit score? Whether you’re aiming to buy your first home, snag that dream car, or simply secure better interest rates on loans, the key to unlocking these opportunities lies in your credit report.

Welcome to the Sharkshop.biz Method – a transformative approach that’s not just about numbers but about empowering you with practical strategies and insider tips to elevate your credit score like never before. Dive into this guide as we unveil powerful techniques inspired by the savvy world of shark tank investments – where every tactic is designed for maximum impact! Get ready to take control of your financial future and swim confidently toward success!

Introduction: Explaining the importance of credit scores and the impact it has on financial stability.

Your credit score is more than just a number; it’s a key player in your financial journey. It can determine whether you qualify for loans, the interest rates you’ll pay, and even affect job opportunities. A healthy credit score opens doors to better financial products and services while a low one can lead to missed chances and higher costs.

Navigating the world of credit can feel overwhelming. But what if there was a straightforward method that could help you boost your score? Enter the Sharkshop.biz Method—a systematic approach designed to help anyone take control of their credit health.

Whether you’re looking to buy a home, secure a loan, or simply improve your financial standing, understanding this method could be your first step towards achieving those goals. Let’s dive into how the SharkShop Method works and how it can transform your credit situation!

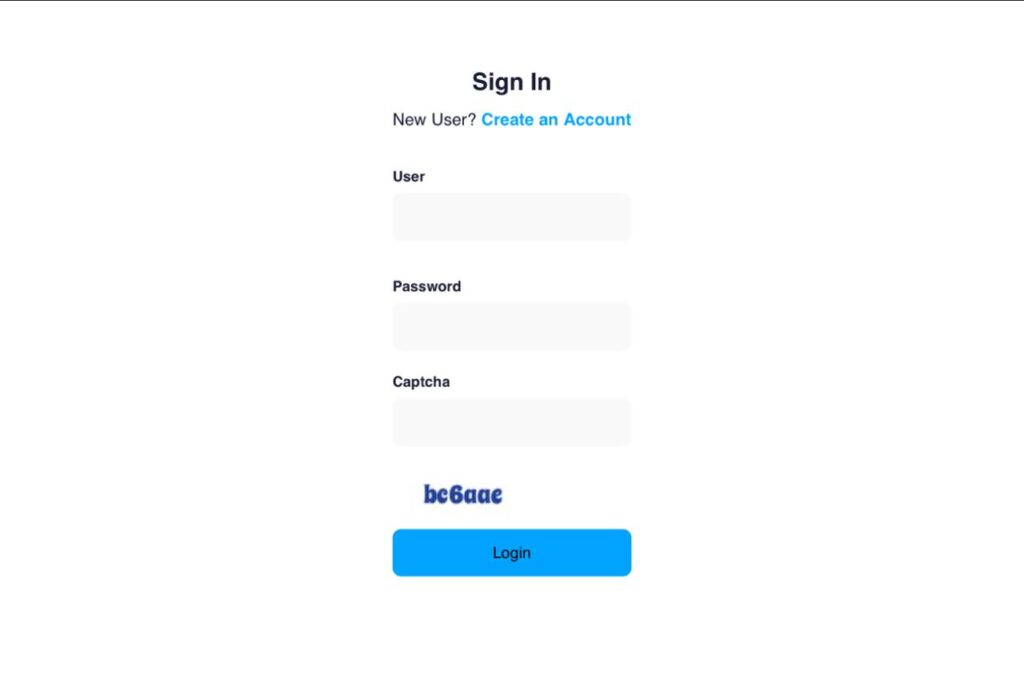

A Screenshot of Sharkshop (Sharkshop.biz) login page

What is the SharkShop Method? Briefly describe the method and its benefits.

The SharkShop Method is a strategic approach designed to boost your credit score efficiently. It combines smart financial practices with actionable steps that anyone can follow.

At its core, this method focuses on analyzing personal finance habits and addressing them systematically. It emphasizes understanding the nuances of credit scores, which is often overlooked.

One significant benefit is its structured framework. Users gain clarity on their financial standing while learning effective techniques to enhance their creditworthiness.

Additionally, the SharkShop Method encourages accountability through regular check-ins and progress tracking. This keeps motivation high as individuals witness tangible improvements over time.

With a blend of education and practical application, this method empowers users to take control of their financial futures confidently. Many have found it not just beneficial but transformative in achieving long-term stability.

Step 1: Analyze your current credit score. Provide tips on how to obtain a free credit report and understanding its components.

To start improving your credit score, you need to know where you stand. Analyzing your current credit score is the first step in the SharkShop Method.

Accessing a free credit report is easier than you think. Websites like AnnualCreditReport.com allow consumers to request a complimentary report once a year from each of the major credit bureaus—Equifax, Experian, and TransUnion.

Once you’ve obtained your report, familiarize yourself with its components: payment history, amounts owed, length of credit history, new credit inquiries, and types of credit used. Each factor plays a significant role in determining your overall score.

Look for any inaccuracies while reviewing the report. Errors can drag down your score unexpectedly. If you spot mistakes or outdated information, disputing them promptly can help bolster your financial standing significantly. Understanding these elements empowers you as you move forward on this journey toward better credit health.

Related: Feshop

Step 2: Identify areas for improvement. Discuss common factors that affect credit scores and how to address them.

Identifying areas for improvement is crucial in your journey to raise your credit score. Start by examining the common factors that influence it.

Payment history plays a huge role. Late payments can significantly lower your score. Setting up reminders or automatic payments helps ensure you never miss a due date.

Credit utilization is another key component. Aim to keep this ratio below 30%. If you’re carrying high balances, consider paying them down or spreading charges across multiple cards.

Length of credit history also matters. The longer your accounts have been open, the better it reflects on you. Avoid closing old accounts unless absolutely necessary; they contribute positively to your score.

Lastly, be cautious about applying for new credit too frequently. Each application can result in a hard inquiry, which may ding your score temporarily. Focus on strengthening existing relationships rather than opening new ones without cause.

Step 3: Implement the SharkShop Method. Explain the specific steps involved in this method, such as paying off debts, setting up automatic payments, etc.

Implementing the SharkShop login Method involves a series of actionable steps designed to boost your credit score effectively.

Start by tackling high-interest debts first. Focus on paying them off aggressively. This will not only reduce your debt load but also improve your credit utilization ratio, a key factor in determining scores.

Next, set up automatic payments for all bills and loans. Consistency is crucial; late payments can significantly harm your score. Automating ensures you never miss a due date.

Consider using tools like budgeting apps to track spending and manage finances better. These resources help identify areas where you might overspend.

Lastly, keep old accounts active by making small purchases periodically. Length of credit history plays an important role in scoring models, so maintaining those older accounts can work in your favor as you implement the SharkShop Method.

Example of Success: Share a success story of someone who used the SharkShop Method to raise their credit score.

Meet Sarah. Just two years ago, her credit score hovered around 580. She felt trapped by high-interest loans and mounting bills.

Desperate for change, she discovered the SharkShop Method. With determination, Sarah analyzed her credit report to identify problem areas. Late payments stood out like a sore thumb.

Step by step, she tackled each issue head-on. Using tips from the method, she set up automatic payments to ensure punctuality. Each month brought small victories as overdue balances dwindled.

After six months of consistent effort, Sarah’s score soared to 720! This improvement opened doors for better loan options and lower interest rates on mortgages.

Today, she’s living proof that with the right approach and dedication, anyone can transform their financial future using the SharkShop cc Method.

Tips for Maintaining a Good

To maintain a good credit score after successfully implementing the Sharkshop.biz Method, consider these essential tips. First, keep an eye on your credit utilization ratio. Aim to use no more than 30% of your available credit at any given time. This demonstrates responsible usage and can positively impact your score.

Next, continue monitoring your credit report regularly for inaccuracies or fraudulent activity. You’re entitled to one free report each year from each of the three major bureaus—take advantage of this opportunity! Dispute any errors you find as they can drag down your score unnecessarily.

Establishing a solid payment history is crucial. Make it a habit to pay bills on time and in full whenever possible. Setting up automatic payments helps ensure you won’t miss due dates while reducing stress around managing finances.

Also, avoid closing old accounts unless necessary; lengthier account histories contribute favorably to your overall credit profile. Lastly, try not to apply for too much new credit at once since multiple inquiries can negatively affect your score.

By following these proactive measures and remaining disciplined with financial habits learned through the SharkShop Method, you’ll be well-equipped to enjoy improved financial health and stability over the long term.