The modern financial ecosystem relies heavily on technology, making transactions faster and more accessible than ever. Whether you’re transferring funds domestically or internationally, one crucial component ensures the security, traceability, and success of your transaction—the UTR number. This blog provides a comprehensive overview of the UTR number meaning, its full form, and its practical usage in financial transactions.

Understanding UTR: What Does It Mean?

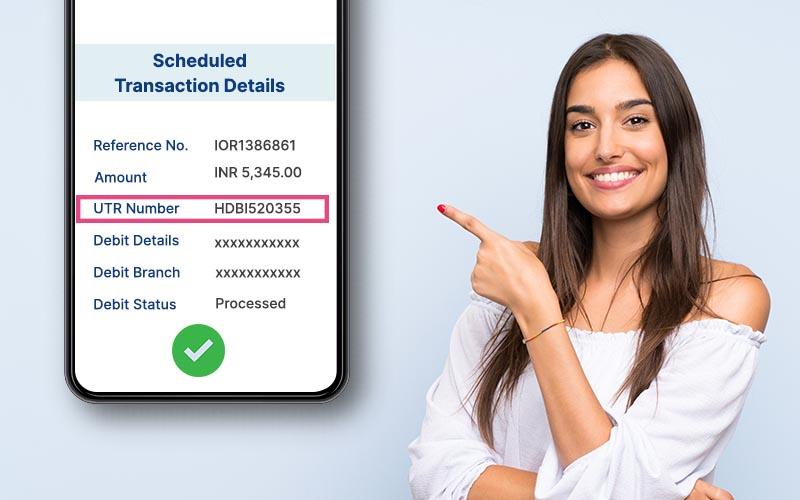

The UTR full form is Unique Transaction Reference Number. As the name suggests, it is a unique identifier assigned to every transaction made through India’s electronic payment systems, such as NEFT (National Electronic Funds Transfer), RTGS (Real-Time Gross Settlement), and IMPS (Immediate Payment Service). This alphanumeric code acts as a digital fingerprint for a financial transaction, ensuring that it can be easily tracked, verified, and referred to when needed.

For example, when you transfer money from one bank account to another, the UTR number associated with the transaction is generated by the bank to identify that specific transfer.

Why Is the UTR Number Important?

The UTR number serves multiple purposes in banking and finance:

- Tracking Transactions:

- It ensures that every transaction is traceable.

- In case of a delay or failure, the UTR number can be used to track the exact status of the payment.

- Resolving Disputes:

- If a sender or recipient disputes a transaction, the UTR number helps banks identify and resolve the issue efficiently.

- Proof of Payment:

- For both individuals and businesses, the UTR number acts as proof of a successful payment.

- This is particularly useful when dealing with vendors, suppliers, or government entities.

- Tax Payments:

- UTR numbers are often used to verify tax payments and ensure compliance with government regulations.

How is a UTR Number Generated?

The UTR number is generated automatically by the bank when a transaction is processed. The format of the UTR number may vary depending on the type of transaction:

- NEFT Transactions:

NEFT UTR numbers are typically 16 characters long. For example: HDFCN123456789012 - RTGS Transactions:

RTGS UTR numbers also follow a similar format but may vary slightly depending on the bank. - IMPS Transactions:

IMPS UTR numbers are shorter, often consisting of 12 characters.

Each UTR number contains specific details encoded within it, such as the bank code, transaction sequence number, and transaction type.

How to Find Your UTR Number?

Locating your UTR number is straightforward and can be done through several methods:

- Bank Statement:

- Check your bank statement, either online or offline. The UTR number is usually listed alongside transaction details.

- Mobile Banking App:

- Open your bank’s mobile app and navigate to the transaction history section. The UTR number is displayed for each completed transaction.

- Transaction Confirmation SMS/Email:

- Banks often send a confirmation message or email after a transaction is completed. The UTR number is included in these notifications.

- Customer Support:

- If you’re unable to find the UTR number, contact your bank’s customer support with details of the transaction.

Practical Usage of UTR Numbers

The UTR number meaning extends beyond just being an identifier. Here are some of its key applications:

1. Banking Disputes:

Transactions don’t always proceed smoothly. A failed or delayed payment can lead to significant inconvenience. In such scenarios, the UTR number is used to locate the transaction in the bank’s database and determine the issue. This ensures quicker resolution compared to manually searching for transaction details.

2. Tax and Compliance:

The UTR number is indispensable in government-related transactions, such as paying taxes, filing GST, or receiving refunds. It provides a unique reference for tracking and verifying payments.

3. Business Transactions:

For businesses, keeping track of transactions with vendors and suppliers is essential. UTR numbers provide proof of payment, eliminating potential disputes and maintaining trust in professional relationships.

4. Cross-Border Transactions:

Although UTR numbers are primarily used in India, similar reference numbers are utilized in international transfers. These numbers ensure transparency and security in global financial dealings.

5. Payment Confirmation:

The UTR number serves as an acknowledgment of payment. Whether it’s a personal transfer or a business transaction, having this number provides reassurance to both parties involved.

Common Questions About UTR Numbers

1. Can a UTR Number Be Used Twice?

No, each UTR number is unique and cannot be reused for another transaction.

2. Is the UTR Number Confidential?

While the UTR number itself isn’t sensitive, sharing it unnecessarily could lead to potential misuse. It’s best to share it only with authorized parties.

3. Can I Generate My Own UTR Number?

No, UTR numbers are generated automatically by the bank’s system when processing a transaction.

Key Benefits of UTR Numbers

- Enhanced Security:

UTR numbers add an additional layer of security to digital transactions, ensuring they are traceable. - Streamlined Banking:

Whether for dispute resolution or payment verification, UTR numbers make banking operations more efficient. - Simplified Record Keeping:

For businesses and individuals, having a UTR number simplifies financial record-keeping.

Conclusion

In an era dominated by digital transactions, understanding the UTR number meaning and its role is critical. It’s more than just a random sequence of characters; it’s the backbone of modern banking, ensuring transactions are secure, traceable, and efficient.

By knowing the UTR full form and its practical applications, you empower yourself to navigate the financial world with confidence. Whether you’re a business owner managing payments or an individual making personal transfers, the UTR number is a valuable tool for ensuring smooth transactions.